HMV owner eyes bid for WH Smith’s high street arm

At the same time, Hobbycraft owner Modella Capital is also said to be in talks with WH Smith regarding a potential purchase

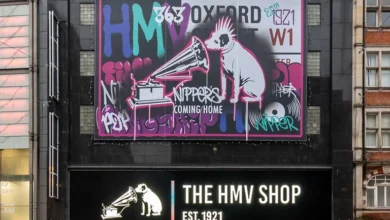

The owner of HMV is reportedly considering snapping up WH Smith’s high street arm, after the retailer this week confirmed it was exploring a potential sale of its 500 high street stores. According to The Sun, it is understood that HMV owner Doug Putman is now in talks with advisers over the move.

The Canadian entrepreneur rescued HMV from bankruptcy in 2019, and previously explored a rescue deal for The Body Shop as well as Wilco, following the group’s collapse in 2023.

At the same time, Hobbycraft owner Modella Capital is also said to be in talks with WH Smith regarding a potential purchase, Sky News has reported.

According to Sky, Modella is one of a “handful” of parties to have held discussions with WH Smith and its advisers.

It added that the likelihood of Modella completing a deal to acquire the 500-store chain was still “unclear”.

This week, WH Smith confirmed that it was exploring the potential sale of its high street stores as it looks to restructure the business, which has seen its Travel business continue to outperform high street outlets in recent years.

Over the weekend, Sky News reported that the retailer has been in negotiations with a number of prospective buyers for several weeks.

Bankers at Greenhill have reportedly been appointed to manage the sale process, with a deal expected in the coming months, according to Sky.

In a statement released yesterday (27 January), WH Smith said: “WHSmith confirms that it is exploring potential strategic options for this profitable and cash generative part of the group, including a possible sale.

“Over the past decade, WHSmith has become a focused global travel retailer. The group’s Travel business has over 1,200 stores across 32 countries, and three-quarters of the group’s revenue and 85% of its trading profit comes from the Travel business.”

It comes as high street profits for the retailer fell by 9% to £39m for the year ended 31 August, which the group said was “in line” with expectations.

Total group revenue for the year was up 7% at £1.9bn however, with a “strong” performance across the retailer’s travel, air, hospital and rail segments, while profit before tax increased by 16% to £166m.

The travel business now accounts for 75% of the company’s revenue, and 85% of profits.