Urbn reports record revenues of $102.9m in Q3

According to the group, the increase in gross profit rate was primarily due to higher initial merchandise markups for all segments primarily driven by Company cross-functional initiatives

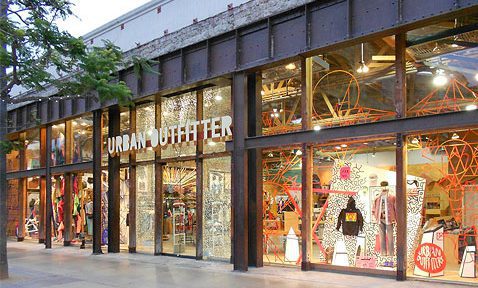

Urbn, which operates a portfolio of global consumer brands including Urban Outfitters, Anthropologie, Free People, FP Movement and Nuuly, has announced record third quarter net income of $102.9m (£80.82m) for the three months ended October 31, 2024.