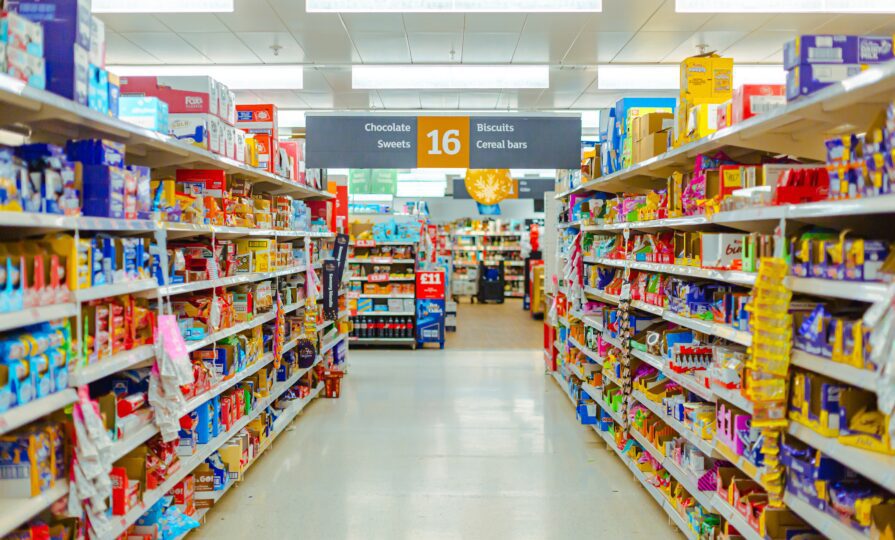

Around 92% supermarket loyalty schemes offer ‘genuine’ savings, CMA finds

People’s concerns about how their personal data is used did not stop them from joining a loyalty scheme – only 7% of those surveyed said they hadn’t signed up to a scheme due to personal data concerns

The Competition and Markets Authority (CMA) has found that people who are members of a loyalty scheme can almost always make a genuine saving on the usual price by buying loyalty priced products.