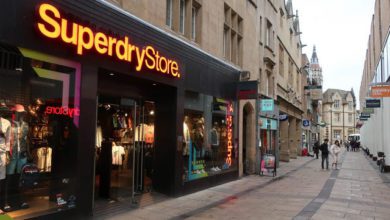

Superdry issues FY24 profit warning amid mild weather

Superdry has secured a secondary lending facility of up to £25m with Hilco Capital Limited, which will provide improved liquidity

Superdry has warned on profits for the 26-week period ended 28 October, attributing a 13% year-on-year drop in sales to “abnormally mild” weather.