Clothing & Shoes

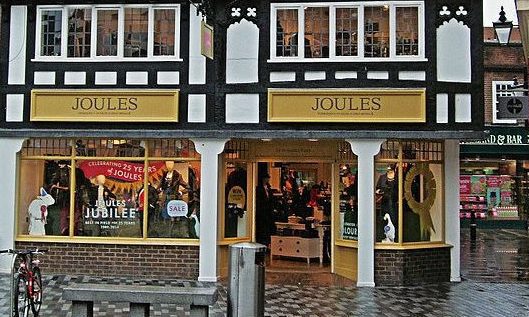

Joules lowers profit forecast amid Covid and supply chain disruptions

Group revenues for the 9 weeks to 30 January 2022 and pre-tax profits are behind the board's expectations

You'll need to

subscribe to unlock this content. Already subscribed? Login?