REPORT: Comparing the US and European retail sectors

Dire predictions of mass bankruptcies in the US retail sector in the face of the ecommerce revolution have come true in the so-called “retail apocalypse”. Changing consumer habits with the growing popularity of online shopping and increasingly easy delivery options have led to slack growth, if not declines in revenue, for many traditional retailers on both sides of the Atlantic.

As customers shifted faster than many traditional retailers expected to online channels, the decline in offline sales left many bricks-and-mortar firms struggling to meet interest payments, ultimately leading them to seek chapter 11 protection from their creditors. In this matter, more than 130 large US retailers have filed for bankruptcy in the past three years, a phenomenon of corporate collapse which Europe outside of the UK has escaped to a certain extent.

But for how long? After all, many of the trends in retail in the US are also playing out in Europe. However, Scope Ratings believes there are several factors which make it unwise to extrapolate from the US experience at least as regards continental Europe. This paper aims to explain some of the many differences between retailers in the old and new worlds.

Key findings

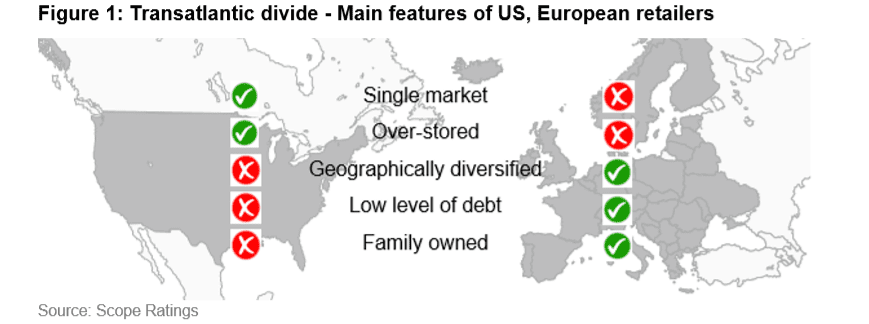

Scope has identified important differences between Europe and the US in assessing the possible disruption to bricks-and-mortar retailers from the boom in e-commerce. The differences range from some divergence between the two sectors, from underlying fundamentals to the way they operate and how they are financed.

The US has a higher per capita proportion of commercial real estate devoted to retailing than other European countries. Public acceptance of online shopping is also well established, representing a major threat to bricks-and-mortar retailers mainly reliant on physical shops to sell their wares.

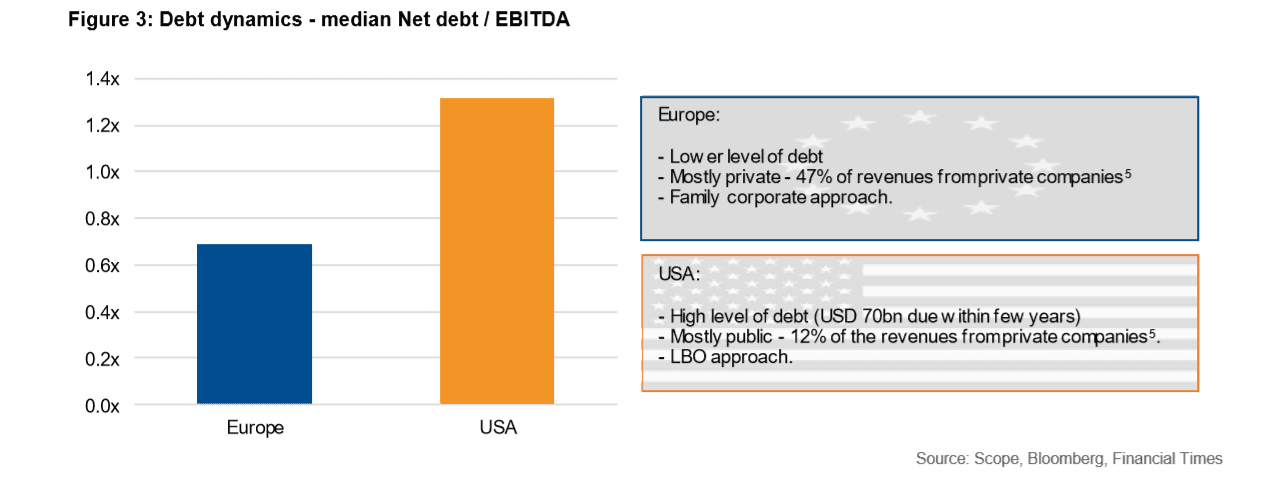

The risk appetite of retailers in the US is also more pronounced than it is in Europe. The prevalence in Europe of privately held and often family-controlled retail companies—with owners eager to hand down the business to the next generation–lends itself to more conservatively managed and financed enterprises. In contrast, US retailers over recent years proved popular targets for leveraged buyout funds. US firms took on significant amounts of debt which in turn left them vulnerable to falling sales and declining interest cover as customers shifted to online shopping.

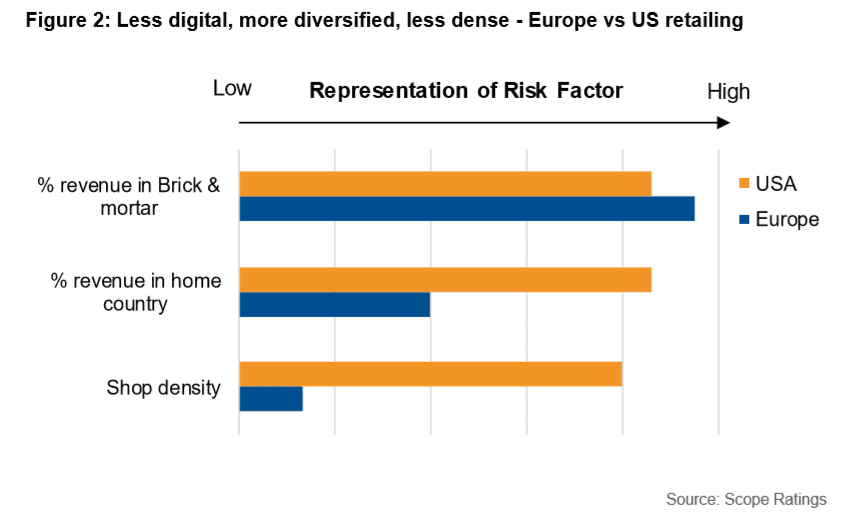

Scope’s analysis also shows that the European bricks-and-mortar sector has a more geographically diverse sales mix, even though less of the revenue is generated online than is typically in the case in the US. Geographical diversification provides extra stability for European retailers, helping them capture much of the growth in the overall retail market. With the notable exception of the UK where traditional retailers have a profile closer to the US, patterns of ownership, financing and the fragmentation of the region’s retail sector are allowing firms more time to adapt to the threats and opportunities of the e-commerce revolution.

Scope sees intrinsic differences between the retail sectors in Europe and in the US. As mentioned in the 2018 Corporate Outlook, the US is “overstored,” with close to six times more retail space (measured by GLA/1000 inhabitants) than in Europe. This relatively high number of bricks-and-mortar shops sits uneasily with the massive shift in consumers to online platforms for their shopping.

To be sure, US retailers have been among the world’s front runners in the development of online offers, supported by popular acceptance for the “new” experience of buying online and having purchases delivered. According to Scope research, US retailers had a median of 14% of their revenues online generated in their latest financial year, versus 5% for their counterparts in Europe.

This high exposure to the online channel helps explain the superior compound average growth (CAGR) in overall sales of 6.5% that the top 65 US retailers recorded between 2011 and 2016 compared with growth of only 4.9% for their top 65 European counterparts. Scope identifies the following three factors in explaining this gap in e-commerce exposure between Europe and the US:

- The popularity of e-commerce differs drastically country by country. While France, Germany and the UK have digital penetration rates of close to 15%–similar to the double-digit rate in the US depending on how retail sales are defined–Spain and Italy each have a rate closer to 5%. In Austria, for example, none of the top 10 largest retailers is a pure-play e-commerce company.

- Despite the EU’s common market for goods and services, e-commerce is complicated by national rules and regulations–among them: Geo-blocking (to be legally lifted in Europe by the end of 2018), data protection laws, hygiene and other product requirements—which have served to fragment the e-ecommerce sector in Europe. The US has essentially a unified commercial market.

- One reason why European retailers were late movers in e-commerce stems from the dominance of many national markets by a few companies. In the case of food retailing in France, Germany, the Netherlands and the UK, the top five largest players have close to a 75% share of each market. This market domination fenced off the sector from some potential new entrants.

Europe lags the US e-commerce revolution with one important exception: The UK. Britain has one of the world’s most developed markets for so-called omni-channel retailing (a mix of physical and online commerce), with high levels of online penetration and public acceptance compared with other parts of the world. Bricks-and-mortar companies have had to react fast to keep online competitors at bay. Many have failed, with recent examples including: fashion store East, shoe retailer Shoon and bed suppliers Feather & Black and Warren Evans.

While the UK’s retail-sector growth potential might be higher given consumer enthusiasm for online and omni-channel shopping, any traditional UK retailers unwilling to profoundly adapt their business models to the digital environment look more at risk than their peers in continental Europe.

While this contrast between how traditional retailers have embraced e-commerce in Europe and the US helps explain the better sales growth that US retailers have reported since 2011, it also hints at the underlying causes of the “retail apocalypse”.

The largest and smallest US 10 companies in a sample of retailers used in Scope’s research benefited from higher weighted average growth rates since 2011 than in Europe (US: large companies: 3.5%; small 20%. Europe: large 1.5%; small 10%).

Smaller companies tend to have had the speed and flexibility to develop online exposure more effectively than their larger counterparts, explaining their comparatively higher growth rates as they take market share from slower movers.

Scope also sees differences in “business philosophy” in helping explain differing rates of growth in the US and European retail sectors. As discussed below, the US retailers are mostly public companies, with executives responsive to the demands of capital markets for rapid growth, dividends and share buybacks.

The European retail industry is comparatively more family owned, leading to a longer-term business focus. While the approaches are not necessarily incompatible, the risk profile of private and public companies can vary enormously. One consequence is the slower growth of e-commerce in Europe, giving bricks-and-mortar companies more time to prepare their strategic response to disruptive online forces.

Within the two continents, the geographic mix of retailers’ sales also differs. According to Deloitte 86% of the revenues of US retailers are generated domestically versus 60% for European retailers, even when they are present in the same number of countries (~10). Beyond having a greater proportion of international sales, European firms tend to attach greater strategic importance to international growth compared with US rivals which have assets that are sometimes just the residue of previous expansion plans which were subsequently reversed. In particular, European retailers’ stronger international exposure allows them to capture above-average sales growth from faster-growing, less-developed markets.

European retail sales increased by 2.7% in January 2018 YoY, confirming the overall trend started in the early 2014. Underpinning the improvement was growth in South-eastern European (SEE) and Central and Eastern Europe (CEE) countries which show the biggest increases in per capita purchasing power. With an estimated 4-5% YoY increase in national currency, this macro development buoyed the growth of the stationary retail sector of these respective countries, a contrast with more modest growth of 1-2% in stationary retail at the European level.

Governance is another factor which is often overlooked in comparing Europe with the US. European retailers are quite often in family or private ownership as opposed to US retailers which tend to be public hands. Taking the 65 largest retailers in Europe and the US, 47% of the revenue was generated by a private company in the Europe against 12% in the US.

Underlying the difference, a vast majority of the US retailers have opened up to leveraged buyout (LBO) funds between 2007 and 2013, leading to higher levels of debt. Scope estimates that the median indebtedness of US retailers is twice that of European peers, with non-adjusted reported financial net debt at around 1.3 times earnings before interest, taxes, depreciation and amortisation compared with 0.69 times in Europe.

The American Bankruptcy Institute estimates that that private-equity (PE) owned retail companies are more likely to file for bankruptcy (17% versus 7% since 2011), a contrast with other sectors where PE-owned firms are generally less likely (14% versus 35%) to seek protection from their creditors through the Chapter 11 process. Scope expects the distress of the US retail sector to persist in the coming years. The sector has close to USD 70bn4 in debt maturing within the next two years–around 30% of that debt is junk rated–while the Federal Reserve is set to raise interest rates.

Conclusion

Booming sales for e-commerce giants like Amazon.com and high-profile bankruptcies among bricks-and-mortar retailers like Toys “R” Us have intensified the digital chill on the US high street. On this side of the Atlantic, Scope expects that traditional retailers are likely to prove more resilient, despite growing online competition and the need to invest in existing stores, better logistics and new technology. Among the reasons is the prevalence in Europe of conservatively financed, privately held and family-controlled companies.

They often have large shares of their domestic market and a significant proportion of international sales, making for robust, if less dynamic, business models. European retailers are also somewhat protected from online competition by national rules and regulations, giving traditional retailers time and space to adapt to shifting consumer habits and competition from home-grown and international e-commerce rivals. Even so, as a forthcoming Scope Ratings e-commerce research paper will show, some retail segments look more exposed to further digital disruption than others.

Report provided by Scope Ratings. The firm is a privately-held rating agency based in Berlin, with offices in in Frankfurt, London, Madrid, Milan, Oslo and Paris. They specialise in the analysis and ratings of financial institutions, corporates, structured finance, project finance and public finance.