Zara owner Inditex misses expectations despite 7% surge in revenues

During the period Inditex said that openings have been carried out in 45 markets and by its end Inditex operated 5,659 stores across the world

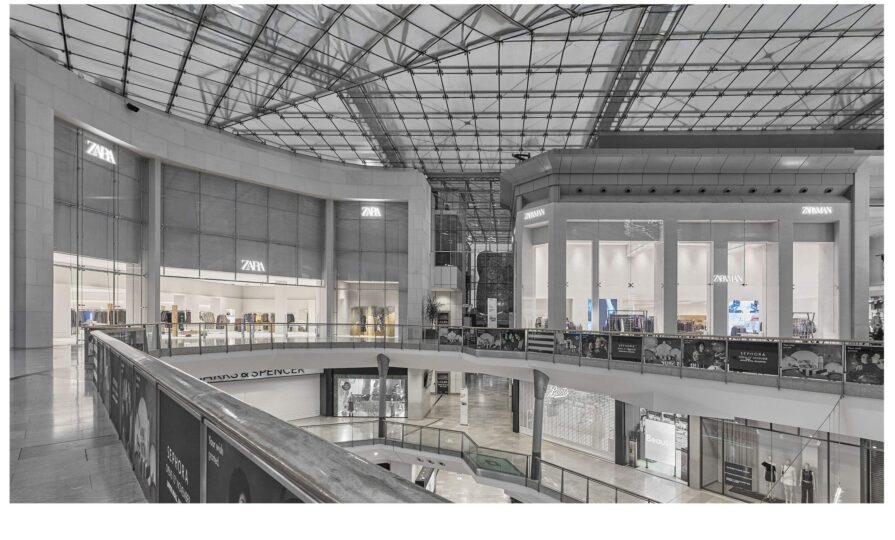

Inditex, the owner of fashion brands Zara, Stradivarius and Berksha, has seen its shares slide 6% in trading after its performance in the first nine months of the year came in below analysts expectations.