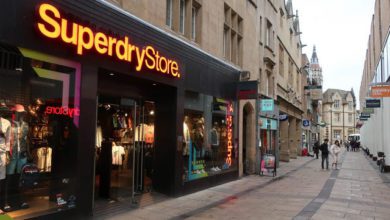

Superdry announces restructuring measures to avoid administration

A restructuring plan, equity raise and delisting from the London Stock Exchange constitute a package of measures that are needed to avoid insolvency

Superdry has revealed its capital and restructuring measures to avoid running an emergency four-week sale process.