Aurelius MD behind Body Shop buyout exits group

It comes as Peter Wood, who had held the position of managing director at the asset management company, reportedly faced criticism over the £207m deal

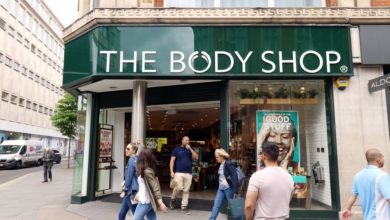

A dealmaker from Aurelius who helped lead its private equity takeover of The Body Shop has abruptly left the group only three months after the deal, The Telegraph has reported.