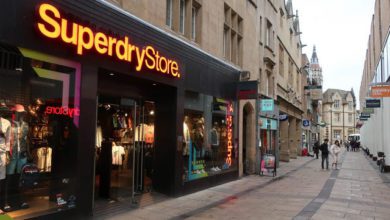

Superdry hires PwC to explore debt options

The clothing retailer is supposedly working with advisers from the firm to review the funding options following a pre-Christmas profit warning

Superdry is believed to have appointed accountancy firm PwC to explore its debt options, Sky News has revealed.