THG guidance remains unchanged despite losses widening

The group still reported a continuing adjusted EBITDA of £50.1m for H1, which increased by 22.9% during the period and has hit the top end of the group’s guidance

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

THG Group has reiterated that its adjusted EBITDA guidance for FY23 remains unchanged, despite its disposal of loss-making assets widening its operating loss to £99.5m in H1, down from a loss of £89.2m last year.

The disposal of loss-making categories and non-core assets, which included its OnDemand business, cost the company £26.2m. However, without this charge, operating loss would’ve improved by £15.9m year-on-year for THG.

In spite of this, the group still reported a continuing adjusted EBITDA of £50.1m for H1, which increased by 22.9% during the period and has hit the top end of the group’s guidance.

The group’s cash performance is also ahead of guidance, representing a £350m cash performance improvement year-on-year. THG also reported £563m of cash and available facilities.

During H1, THG had “record” revenue of £340.7m for its nutrition business, increasing by 2.6% with adjusted EBITDA increasing by 71.9% to £47.1m.

Meanwhile, THG Beauty’s adjusted EBITDA reached £10.6m compared to £17.7m in H1 2022, due to the impact of one-off industry destocking in manufacturing. Excluding manufacturing, THG Beauty’s adjusted EBITDA was £9.7m compared to £7.3m last year.

According to the group, the beauty division has returned to growth since the start of August.

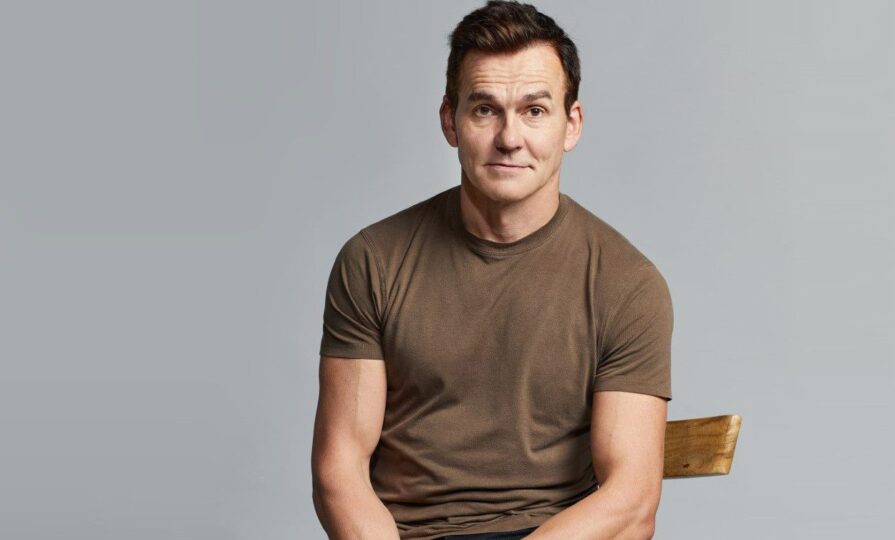

Matthew Moulding, CEO of THG, said: “Inflationary pressures provided significant challenges to consumers and businesses alike over the past 18 months. Our strategy of supporting our consumers through 2022, sacrificing margins in the short-term, is bearing fruit.

“Group cash flow performance improved by £350m compared to the previous 12 months, reflecting the completion of our global infrastructure roll-out program, with the group now achieving significant operating leverage from a well invested, automated, global platform.”

He added: “Recent progress within our beauty division has been more encouraging, underpinned by strong performances in the group’s Perricone MD and ESPA brands, as well as across Cult Beauty. Margin improvements have steadily built through H1, as focus shifted to orders that deliver immediate profitability.”