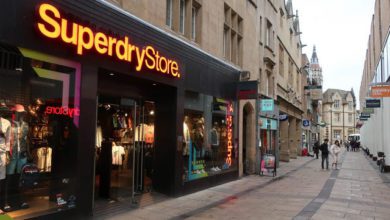

Superdry falls to £148m loss in FY23

While Superdry’s revenues grew 2.1% to £622.5m in FY23 due to a 14.7% store revenues increase, its retail growth was offset by a 19.1% decline in wholesale

Superdry swung to a loss of £148.1m in the year ended 29 April, down from a profit of £22.4m the prior year.