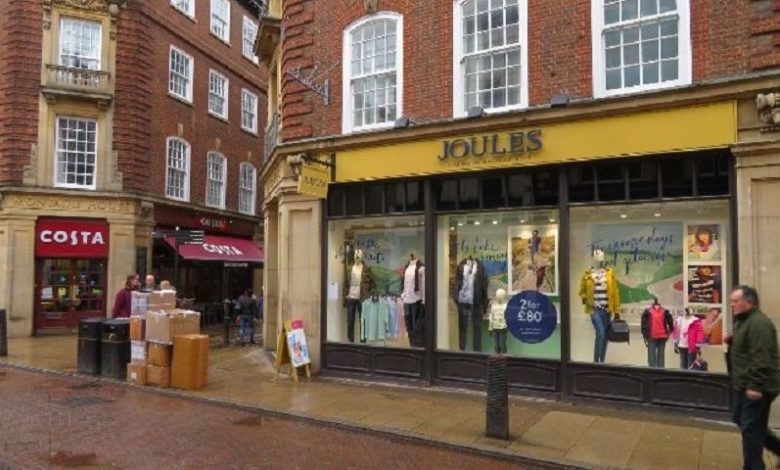

Joules faces FY loss as summer sales suffer

Trading has been hit by the warm and dry summer weather, which has reportedly damaged sales of its core categories such as outerwear, rainwear, knitwear, and wellies

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Joules has warned that it expects to deliver a full-year loss that is “significantly” below market expectations in its next financial results, amid rising inflation and weak trading in recent weeks.

Over the five weeks to 14 August, since its last trading update in July, the group noted trading has “softened materially”.

It partly attributed this to the “extremely” warm and dry summer weather, which has reportedly damaged sales of its core categories such as outerwear, rainwear, knitwear, and wellies, and has compounded subdued consumer demand amid the cost-of-living crisis.

Retail sales were consequently hit over the five-week period, resulting in an 8% year-on-year fall in retail sales in the 11 weeks of the current financial year to date.

While wholesale trading saw a 10% growth year-on-year, despite delays experienced in US ports, its Garden Trading wholesale also continued to be “significantly” impacted by the wider slowdown in the home and garden market.

Overall, retail margins in the year to date have fallen by around 6% year-on-year, reflecting the shortfall of full price sales and level of discounting that has been required to engage customers.

Despite this, the group said it still expects partial recovery in the coming months as sales of full price Autumn/Winter collections “become a more important part of the mix”.

In its latest update, the group also noted that it continues to have “positive discussions” with Next regarding the adoption of its Total Platform services, as well as a potential equity investment. It added that “there can be no certainty that these discussions will lead to any agreement”, however.

In its latest update, Joules said: “As a result of the recent softness in trading and the current weak consumer sentiment set out above, the board expects a significant loss in the first half, followed by an improved performance in the second half as the benefits of business simplification begin to be realised.

“In light of this, the board currently expects the group to deliver a full year loss before tax, and before adjusting items, significantly below current market expectations.”