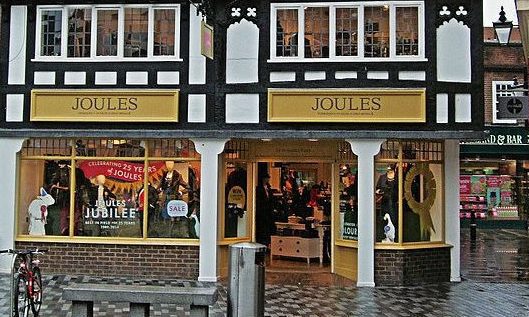

Joules raises FY profit guidance as cost cuts bear fruit

It added the group is making good progress on its plans to improve profitability by simplifying the business and optimising the cost base

Clothing and homeware brand Joules has revealed it expects FY22 adjusted profit before tax and adjusting items to be “slightly ahead of current market expectations” as its additional cost reductions begin to bear fruit.